When trying to make a decision on which city is the best city to own a horse property, one should consider all of the reasons why the location is a good choice. One should look at how close it is to major highways, whether there are public transportation options, how many other people and businesses are in the immediate area, and how much the monthly rental fees are. Whether you are planning to buy a farm or one of those professionally managed race horses, these cities have everything that you need.

Greenville, South Carolina

Greenville, South Carolina is easily one of the best cities to own a horse property because it has an abundance of available equestrian properties. The city has an abundance of horse farms and tack facilities that cater to equestrians of all levels. Horse properties in Greenville, SC give you the opportunity to own and raise your own horse or pony so that you can compete in the most prestigious equestrian shows in the nation.

When looking at the available equestrian properties in Greenville, South Carolina there are two main types of land use. Large tracts of pasture with plenty of room to move and groom are available and many people enjoy the equestrian properties that allow them to take full advantage of the natural beauty found in the mountains. The large variety of pasture land and equestrian properties makes finding the right place to purchase a horse property a snap. You can find both freestanding and mounted tack on a multitude of different locations including free riding and groomed pastures. Many of the horses that are raised on free riding hills have come from young foals that have been hand tied by their mommies after she gives birth and then sent to live at a stable until they are old enough to roam freely on their own. There are also horses that are rescued from abusive situations and are trained to be the perfect companion for those people who love to spend time riding horses.

Another great feature of the Greenville SC area is that the equestrian landscape is vast and varied. The climate is cool and mild and the horses need little maintenance or help when they need it. If you want to own a horse and make sure that the animals get the care and attention that they need while living in the best climate in the world, the Greenville SC area is the perfect place to invest in your new horse property. The large amount of acreage available and the fact that there is no pollution to worry about will give you peace of mind when making your investment decision.

Middleburg, Virginia

Another great city to own a horse property is none other than Middleburg, Virginia. It is considered as one of the best locations to buy and lease a horse. There are many reasons why this city is considered as one of the best places in the world to do business in horse property leasing and buying. One of the main factors that make Middleburg a wonderful choice for horse property is that it has all of the amenities and safety measures needed by the horse owners.

Unlike some of the other places that you might find, Middleburg does not have an excessive amount of horse acreage. This makes equestrian properties much more affordable and accessible. There is also no shortage of room for expansion and growth of the horses or the equestrian businesses associated with them. This is what makes Middleburg the best city in which to buy and lease a horse.

Another reason why owning a horse property in Middleburg is such an excellent option is that the city is served by four major highways and twenty bridges. These highways connect major cities all over the country and offer great scenery in the process. Additionally, the roads head towards Canada and the Atlantic Ocean ensuring easy access to the best horse riding destinations in the world. The beautiful countryside also makes for a fantastic destination for equestrian lovers.

Woodstock, Vermont

The beautiful town of Woodstock, Vermont is nestled between two mountains and surrounded by a lush green landscape. There are miles upon miles of trails for you and your horse to explore. In addition to this there is an abundance of horseback riding, skating, and carriage rides available. The people of Woodstock are welcoming to visitors from around the world and there is no better place to visit in order to take in all that this beautiful and historic town has to offer.

Woodstock has all the necessities for a comfortable living including a good hospital, grocery store, doctor, and many of the services that you would expect from a small town. With a large population, this city has plenty of job opportunities for those looking to be a horseman or horse breeder and you will not have a hard time finding a job.

Ocala, Florida

There is a wide range of equestrian properties in Ocala, Florida that will allow you to get out into the open and into the cooling breezes and the cool grass. The climate in Florida over the months of April through September is considered mild with temperatures around seventy-five to eighty degrees, but the warmer months remain much more humid, regularly reaching ninety degrees. If you are looking for a horse property, then the time of year and the type of climate are two of the most important factors that should be considered.

Wellington, Florida

If you are looking for a relaxing and comfortable atmosphere, then Wellington Florida is perfect. You will find that there is everything you would want from an outdoor living space, including amazing views of the Gulf of Mexico. In addition, you will also find plenty of equestrian properties available that include barns, stables, and horse trailers. Whether you have a large or small horse, you can find a great piece of property to call your own, but make sure you understand your property rights in the state.

No matter what your needs are for owning a horse, Wellington Florida will be able to give you what you are looking for. In Wellington, you will find Wellington horse trailer parks that have a variety of different types of trailers. You will also find equestrian properties that are available for lease. Whether you are looking for a year-round pasture or you are just looking for a place to relax with your horse in the summertime, there is something for everyone in Wellington Florida. With the weather being as hot as it is during the spring and summer months, you will be able to find the perfect place to purchase property for your horse.

Lexington, Kentucky

Lexington, Kentucky is one of the best cities in the United States to own a horse because of many factors. The climate of Lexington is mild to moderately cool. This allows equestrian properties in the city to thrive year round regardless of the temperature. Also, equestrian tenants can enjoy all of the fun activities and competitions that are hosted in the town during the summer. While other cities may have warm days occasionally, they don’t allow as much of a chance for the horse lover to get away from it all and enjoy some horseback riding or trail rides during the spring weather.

Another reason that Lexington is the best city to own a horse property is that the city is full of exciting things to do with regards to horses. The Bluegrass State Park has horse trails where the equestrian trail runners can test their mettle and the riders can also learn about the history and culture of the American southwest. The largest animal shelter in the country is located in Lexington and it is open to people who would like to take part in horse adoption. Also, the Kentucky Horse Park offers horse shows and clinics to educate the public about proper care and grooming of horses. As someone interested in equestrian properties, owning a house on a stable in a quiet and peaceful place is an ideal way to make horse ownership a reality and even make some extra money in the process.

San Antonio, Texas

There are a variety of equestrian properties in the city of San Antonio that are available to the people who wish to invest in them. The competition among the different equestrian property companies has made the prices go down quite a bit. One of the best things about investing in this particular type of investment is that it is a safe bet that the value of the asset will appreciate in the coming years.

San Antonio is the perfect place for horse lovers and investment seekers. There are so many people who visit this part of the country on vacation, seeking to enjoy the warm weather and all that it offers. Investing in the equestrian industry makes a lot of sense because the city of San Antonio is the home of the San Antonio Horse Park, which is considered to be one of the best horse property destinations in the entire United States. The horse property is priced well below market value, which means that if you are willing to invest in it, you will definitely be able to make good returns.

Conclusion

The top horse places in the United States usually have a lot of land to accommodate the horses and an excellent infrastructure to support them. Some of the professional race horses are treated like celebrities and are even allowed to spend their days and nights at the pool, gym, or whatever they wish. As long as the place provides adequate accommodation and enough horse-related paraphernalia for the horse’s needs, you will be able to give the animal the best of care. You may also hire an equestrian properties manager to take care of other things for you while you keep an eye on the horse.

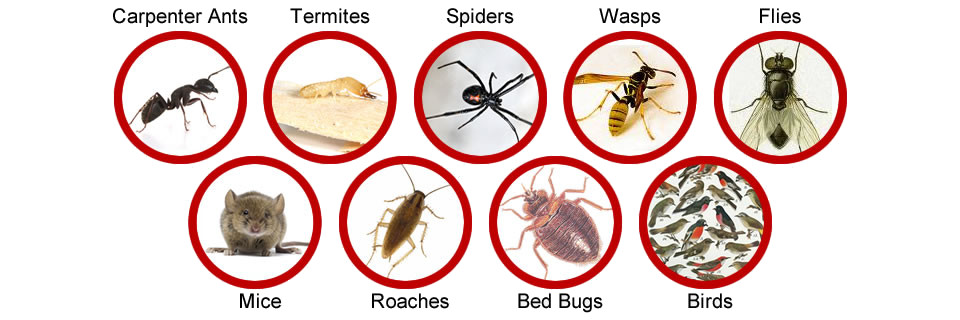

Often it may seem like you are losing the battle when it comes to some of the household pests such as ants and roaches; this is the time to call in pest control.

Often it may seem like you are losing the battle when it comes to some of the household pests such as ants and roaches; this is the time to call in pest control.

You can expect the maintenance for waterfront homes to be a little more extensive than that of homes that are not located near the water. For example, you might want to consider adding in additional maintenance checks and precautions depending on where you live. If you live near the ocean, the salt from the ocean can do damage to certain materials, so preparing for that prior to building or purchasing is essential. Of course, flooding can occur, high winds, etc. While the upkeep might be a little more taxing, most waterfront homeowners find the extra work well worth it.

You can expect the maintenance for waterfront homes to be a little more extensive than that of homes that are not located near the water. For example, you might want to consider adding in additional maintenance checks and precautions depending on where you live. If you live near the ocean, the salt from the ocean can do damage to certain materials, so preparing for that prior to building or purchasing is essential. Of course, flooding can occur, high winds, etc. While the upkeep might be a little more taxing, most waterfront homeowners find the extra work well worth it.